Developing Palo Alto is worth $1 trillion

And every household that lives there now could have $30 million

There is a common narrative that so-called NIMBYs (I don’t like the term) oppose new development near them because they want to maximise their house prices. This is a myth – this post will explain why.

There is a second common narrative, which holds that these so-called NIMBYs oppose new development near them because it causes concentrated harms, such as congestion, competition over state-provided resources, noise, and disruption. They are able to organise, such that even though its dispersed benefits – infinitesimally better housing for everyone in the country – outweigh these concentrated costs, opponents of development are able to win and block building and keep zoning or planning rules strict.

This story is also false, because these benefits can be concentrated as well, in the form of a single developer or landowner who ‘captures’ them all, to pay off the local objectors. If the benefits of development outweigh the costs, this developer should be able to pay them enough to get nearly all of them to say ‘yes’.

Let’s illustrate this with an example.

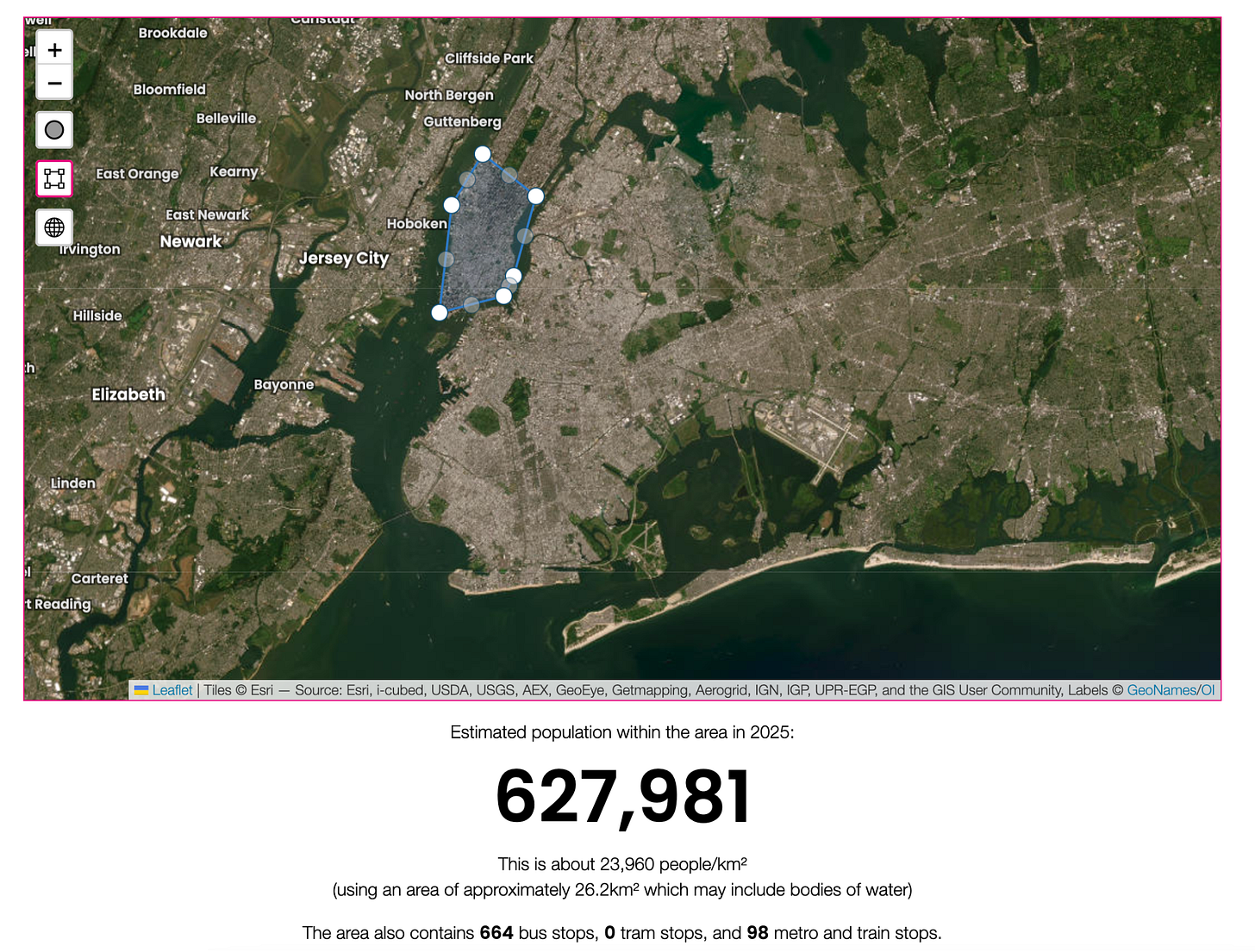

Lower Manhattan (the bit South of Central Park, including Midtown, the Financial District, and everything inbetween), is about the same size as Palo Alto in San Francisco excluding its parks and nature reserves: around ten square miles.

Although they are about the same size, as you must surely know, Lower Manhattan is incredibly densely built up, with an enormous supply of offices, hotels, restaurants, bars, artist studios, shops, and more. The daytime population of the whole of Manhattan is about double its nighttime population: the 24,000 people per square kilometre who live there. By contrast, Palo Alto sees very few visitors, and has ten times fewer people per square kilometre, because it is largely one-storey and two-storey suburban homes.

Property prices average $1,800 per square foot in Palo Alto. Building costs in San Francisco are about $400 per square foot (the most expensive in the world by some metrics). But to get to (East) Midtown Manhattan floor area ratios of 14.3 (14.3 means that the building has 14.3 times as much floorspace as the plot of ground it uses), we’re going to have to build taller than most Bay Area construction, so let’s call it $700 per square foot. Midtown East is about 60 percent covered in buildings if you include roads (each 18 hectare block is 11 hectares of buildings, three hectares of gardens and courtyards, and four hectares of road and sidewalk space), meaning that the net floor area ratio could be about eight.

If there was no price response, there would be $1,100 profit per square foot. Duranton and Puga’s estimates imply that several million (probably tens of millions) of people would migrate to the Bay Area from other parts of the US if housing was more affordable there. I think adding around 500,000 people to get to Manhattan’s population density, while adding a huge amount of office, lab, and retail space as well, would by no means be enough to drive prices to the cost of construction, but let’s assume that they just do, so the last block profits by $0.01. That (a 45 degree demand curve) means that the profit per square foot will be $550.

Multiply that up:

$550 of profit per square foot, times

A floor area ratio of eight, times

10 square miles in square feet – 278,800,000

You get $1.2 trillion in profit after building costs, which includes the sorts of basic infrastructure developers usually provide. I think we need to put in some expensive transport infrastructure: let’s say we build 30 miles of subway, about what Manhattan has in that area. We can build it cut and cover on freshly demolished land, so it would likely be quite cheap, but let’s assume that we have to do it at BART prices of $2 billion per mile: total of $60 billion. Let’s say we also need to tunnel 30 miles of road at the exorbitant costs of the Fort McHenry Tunnel (about $1.5 billion per mile). That’s another $45 billion.

So we have about $1 trillion left over. There are about 26,000 households in Palo Alto. That’s enough for $30 million per household who lives there plus a $220 billion contingency fund.

So if Palo Alto decided to sell off its entire land to a developer, then upzone it to Midtown East levels, they could give each household $30m (or a share in the development worth that much), build America’s second-biggest subway network and longest road tunnels, and have $220 million left over for contingencies. The average property in that city is worth about $3 million. Who would prop up their $3 million house price at the cost of losing $30 million?

What I just read is one of the most insanely idiotic blog posts I have ever read. At no point in this rambling, incoherent blog post were you even close to anything that could be considered a rational thought. Everyone in this discussion thread is now dumber for having read it. I award you no points, and may God have mercy on your soul.